Natural Capital

Public - visible to all visitors to the platform.

Open to join - users can join this group without approval.

About this Discussion

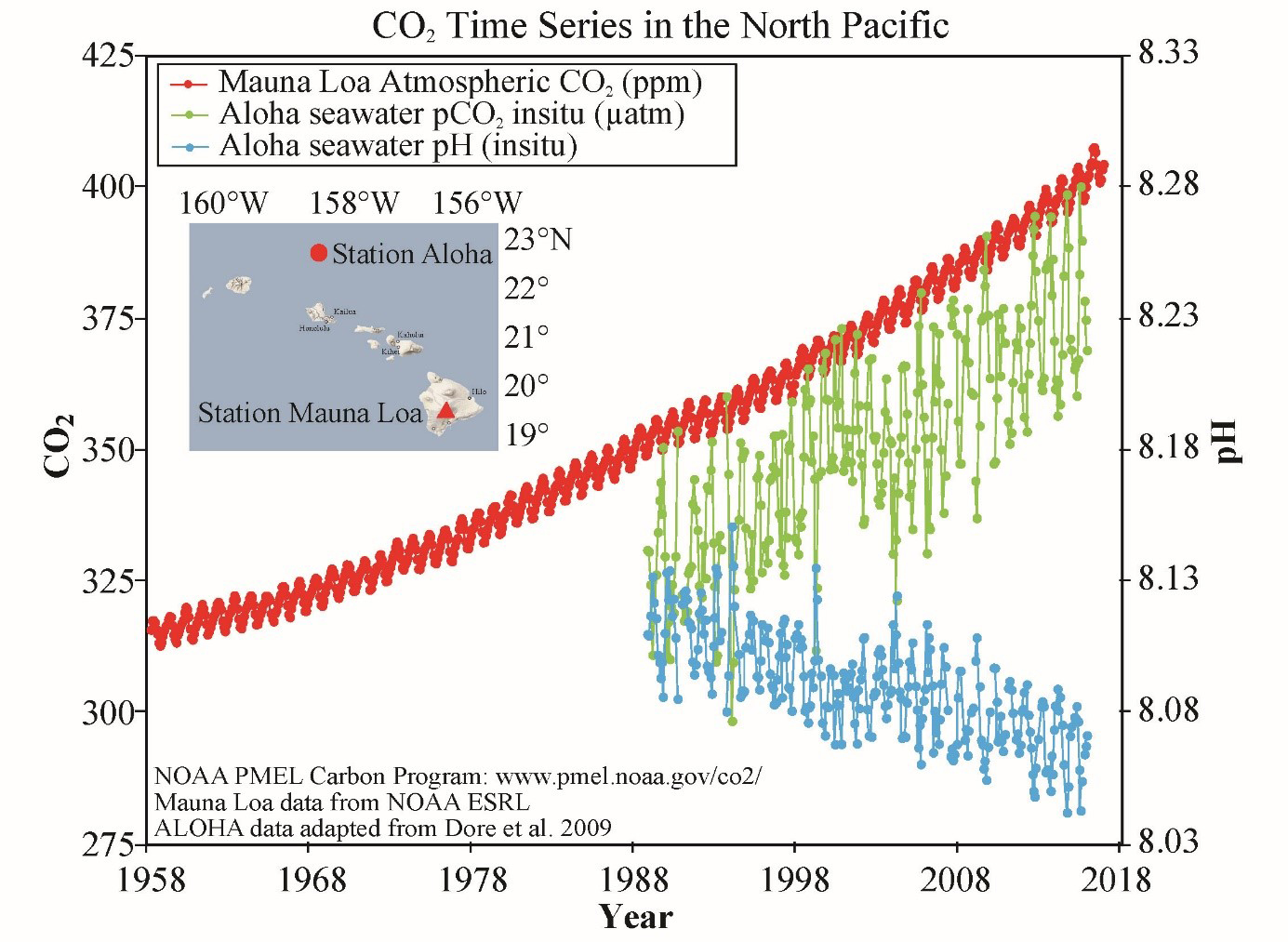

Natural capital encompasses the world's living and non-living natural assets. It forms the basis for environmental and economic life through natural resource production and the provision of ecosystem services. Natural resources are the foundation of social and economic development. Given the critical role they play in maintaining biodiversity and enabling green economic growth, safeguarding such assets could not be more pressing.

To incorporate natural capital into national green growth planning, it is critical for decision-makers to have access to information that reflects the quality, quantity and spatial configuration of natural capital assets. The utility of natural capital analysis for policymaking is ultimately dependent on the availability of information, which can be provided through data platforms and tools.

The GGKP’s Natural Capital Expert Group is currently exploring state-of-the-art methods, models, data and tools for mainstreaming natural capital in national green growth policies and practices. The group is leveraging global momentum for green growth in order to better value, protect and enhance natural capital in national economic decision-making.

Upcoming Events

Informative message

Natural Capital

Created a Post in Cities and Urban Development, Natural Capital, Water and Sanitation

Created a Post in Sustainable Finance, Natural Capital

Created a Post in Climate Change, Natural Capital, Water and Sanitation

Created a Post in Blue Economy, Natural Capital, Tourism and Hospitality

Created a Post in Agriculture, Natural Capital, Tourism and Hospitality

Created a Post in Cities and Urban Development, Climate Change, Natural Capital

Created a Post in Natural Capital, Forestry, Green Recovery from COVID-19

Created a Post in Climate Change, Natural Capital, Water and Sanitation

Created a Post in Cities and Urban Development, Climate Change, Natural Capital

Created a Post in Natural Capital, Sustainable Finance