Huge investment is needed to meet global environmental targets. The Green Growth Knowledge Partnership (GGKP) and the Basque Centre for Climate Change together found that additional investment of over $700 billion per year is needed to meet the eight natural capital-related SDGs by 2030. The sooner investment in nature is scaled up, the smaller the overall cost will be. An analysis commissioned for the Dasgupta Review estimated that delaying action and investment by 10 years would more than double the cost of stabilizing biodiversity by 2050.

This delay could make the scale of change so large that it is probably unfeasible to achieve. Furthermore, not investing in good natural resource use management carries severe risks: irreversible breakdowns of terrestrial, freshwater and ocean ecosystems that threaten the foundations of social and economic provisioning systems upon which billions of people rely. Such a breakdown also threatens the cultural and regulating services that are crucial for human well-being.

But all is not lost.

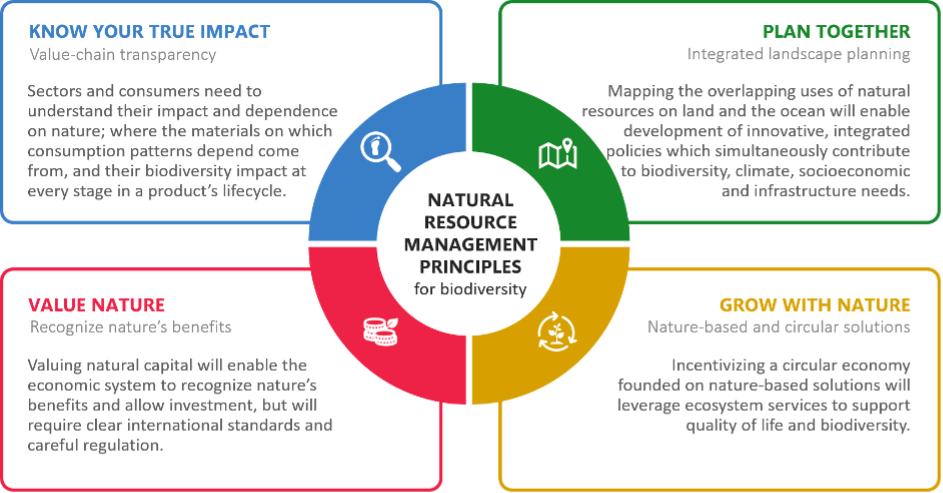

APPLYING NATURAL RESOURCE MANAGEMENT PRINCIPLES

Natural resource management principles can help mitigate the risks. Natural resource use management principles are about knowing your impact, planning together, growing with nature and valuing nature. Because they address the root drivers of biodiversity loss, these principles can ensure that financial flows channeled towards biodiversity and natural assets achieve maximum impact.

The OECD’s overview of global biodiversity finance found that the majority of biodiversity finance was spent by governments on domestic biodiversity conservation. This flow of funds is making a positive difference towards conservation efforts, but could be made even more effective if it was informed by integrated spatial plans. To ensure that investment in nature is as effective as possible, it would be necessary to have a complete picture of how natural resources are being used, and how their uses impact each other.

Without an integrated strategy, conflicting demands for limited space will not be optimally balanced. There is a chance that investment would not be channeled to where it would have most impact on biodiversity. Having such a strategy enables investors and decision-makers to conserve biodiversity and to achieve multiple benefits from areas of land or ocean. Laying out all the demands together makes it easier to consider the natural resource needs of different stakeholders, highlighting where there are trade-offs and where there could be win-wins.

For example, marine protected areas increase fish populations for neighbouring fisheries while at the same time provide livelihoods from sustainable tourism. In 2019, the International Resource Panel (IRP) analysed over 350 integrated spatial planning initiatives from around the world, and found that a large proportion had positive impacts on agriculture, ecosystems and livelihoods.

Figure 2: Natural resource management principles for biodiversity. Source: IRP (2021). Building Biodiversity: The Natural Resource Management Approach. Potočnik, J., Teixeira, I. An opinion piece from the International Resource Panel Co-Chairs

MAKING HIGH-VALUE CHAIN TRANSPARENCY A REALITY

High-value chain transparency would make investments even more effective across value chains. Value chains relying on nature fail to account for the negative impacts these economic activities have; verification remains a challenge and the need for greater transparency is widely seen by those advising policymakers on green finance.

Value chain transparency is already driving investment, encouraging investors to invest in companies acting to limit their impact on, or even enhance, nature and biodiversity. It is encouraging investment in business models with less harmful environmental impact from extraction to production and consumption. Portfolios are taking an increasing interest in finance to support biodiversity, but have found it difficult to invest directly because positive impacts are not straightforward to measure.

The Zoological Society of London has developed an online platform to help with this: it details the activities of soft commodity producers, enabling proactive investors to avoid companies that have particularly damaging impacts, and to identify specific natural resource management strategies improving how activities, such as deforestation, are managed. This tool is already being used by first-mover fund managers to invest in impacts such as better farming practices, through to better consumption patterns, including reduced waste, and less resource-intensive food products. Policymakers can play an important role in making value chain transparency a reality by investing in strong scientific data and working to agree on consistent international standards, for example based on the IRP’s impact footprint methodology.

Another way financial flows could be made more effective is by harnessing nature’s inherent regenerative capacity. Financial actors can support nature by investing in business models that grow value by producing natural materials and enhancing ecosystem services simultaneously. These production practices avoid landscape degradation, minimize waste and assist the recovery of ecosystem functions.

One example is the planting of bamboo to support poverty alleviation. The plant grows so fast and is easy to harvest that is can restore degraded landscapes and provide livelihoods from production simultaneously, as shown by case studies from China, Ethiopia, India, Ghana and Tanzania. In Tanzania, over 1,000 jobs were created, bringing additional household income to communities.

There is potential for much greater investment in nature-based and circular solutions, which deliver for climate as well as livelihoods: it is widely quoted that only 3% of international climate finance goes towards nature-based solutions, despite their high cost-effectiveness relative to other contributions.

INTEGRATING NATURE INTO ECONOMIC DECISION-MAKING

Economic and financial systems need to fundamentally change – they need to account for nature’s inherent value. The way these systems currently operate does not recognize the intrinsic value of natural assets and the services they provide, which contributes to the mismanagement of natural resources. Integrating nature into economic decision-making is not the same as merely putting a price on nature.

The Dasgupta Review recommends creating a global financial system that supports nature by recognizing its true value. Governments could support this through grounding economic decisions on an inclusive measure of wealth, based on human, produced and natural capital, thereby incorporating ecosystem extent and quality into central policymaking and sending strong market signals. There are already tools helping decision-makers to do this. For example, the open-source modelling suite InVEST (Integrated Valuation of Ecosystem Services and Trade-offs) can map and value contributions nature makes to people, including water quality regulation, flood protection, and crop pollination. Another tool, ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure), enables users to visualize how economic activities depend on nature, and how degredation of natural capital exposes businesses to risk.

Instruments including payments for ecosystem services (PES) schemes can reward actors for protecting and enhancing natural capital. Although such instruments are still relatively rare, there are an increasing number of examples. One such initiative is the Araguaia League in Mato Grosso, Brazil. Aiming to improve the region’s environmental assets, it financially compensates activities encouraging sustainable intensification of cattle production, including conservation and greenhouse gas emissions reductions.

There is a growing acknowledgement that economic activity impacts nature, but is also dependent on it. This is reflected in the work of the recently launched Taskforce on Nature-Related Financial Disclosures, which aims to deliver a framework for organizations to report and act on nature-related risks, supporting a shift towards nature-positive financial flows.

We need to use natural resource management to create positive market signals that incentivize the transparent, circular and regenerative use of natural resources, aligning public and private interests. We need to use natural capital in decision-making and incorporate externalities in the prices of goods and services to address distorted economic systems. Ultimately, we must change how industries, governments and societies are incentivized to use natural resources. The Dasgupta Review reminds us that although its role is deeply connected to a broader regulatory landscape, the financial system occupies an important position in correcting current market and institutional failures by acknowledging that its activities fundamentally rely on nature, and are not external to it.

###

About the Report: Building Biodiversity - The Natural Resource Management Approach

Efforts to protect and restore nature have overlooked the biggest single factor in biodiversity loss: the world’s inefficient and irresponsible use of natural resources. In a new report released ahead of CBD COP15 in October 2021, the Co-Chairs of the International Resource Panel (IRP), Janez Potočnik and Izabella Teixeira, outline science-based principles to help policymakers move beyond pledges and commitments, and look to natural resource management approaches to acknowledge, understand and address the direct and indirect drivers of biodiversity loss for climate, nature and socially just economic and social development.

About the International Resource Panel

The International Resource Panel (IRP) was launched by the United Nations Environment Programme (UNEP) in 2007 to build and share the knowledge needed to improve our use of resources worldwide.

The Panel consists of eminent scientists with expertise in resource management issues. It studies key questions around global resource use and produces assessment reports that distil the latest scientific, technical and socio-economic findings to inform decision-making.

The Panel provides advice and connections between policymakers, industry and the community on ways to improve global and local resource management. The Panel includes scientists and governments from both developed and developing regions, civil society, industrial and international organizations.

Its goal is to steer us away from overconsumption, waste and ecological harm to a more prosperous and sustainable future.